|

|

In August, Southern Company and AGL Resources announced an agreement to create America’s leading electric and natural gas utility company. Pending regulatory approval and completion of the transaction, the combined companies will become the second-largest utility company in the United States as measured by number of customers.

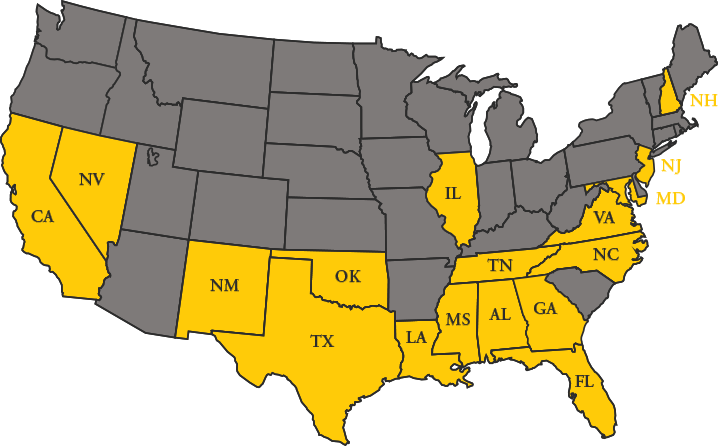

The merger will aggregate 11 regulated electric and natural gas distribution companies, serving some 9 million customers with a projected regulated rate base of approximately $50 billion. The combined company will have a generating capacity of approximately 44,000 megawatts and operate nearly 200,000 miles of electric transmission and distribution lines and more than 80,000 miles of gas pipelines.

Southern Company is already one of the largest consumers of natural gas in the U.S., with natural gas accounting for nearly half of the electricity generated to serve customers’ needs. We expect the addition of AGL Resources’ network of natural gas assets and businesses to provide a more robust platform for long-term success with increased opportunities to invest in additional infrastructure and energy solutions. A natural outgrowth of our commitment to provide real solutions for America’s energy future, the merger is expected to help address one of the key challenges facing today’s energy industry–the development of infrastructure necessary to transport affordable natural gas to areas where it is increasingly needed.

Upon finalization of the merger, AGL Resources will become a new wholly owned subsidiary of Southern Company in a transaction with an enterprise value of approximately $12 billion, including a total equity value of approximately $8 billion. Until the transaction has received all necessary approvals and has closed, the companies will continue to operate as separate independent entities. After the transaction closes, AGL Resources will continue to maintain its own management team and board of directors.

We believe this merger will be attractive to investors because we expect it to create a leading platform that is well positioned for growth across the energy value chain. The transaction is anticipated to be accretive to Southern Company’s earnings per share in the first full year following its closing.

Likewise, we believe this merger makes sense for customers because we expect it to strengthen reliability and improve current and future energy infrastructure development. The cornerstone strength of both companies is our shared commitment to providing customers with outstanding service and innovative energy solutions. The transaction is not expected to increase electric or gas rates for any of the utilities of either Southern Company or AGL Resources.

The companies expect to complete the transaction in the second half of 2016.

Gas Utilities